Capital Credits

Because Jay County REMC is a cooperative, owned by its members, it does not technically earn profits. Instead, any revenues over and above the cost of doing business are considered “margins.” These margins represent an interest-free loan of operating capital by the membership to the cooperative. This capital allows Jay County REMC to finance operations and — to a certain extent — construction, with the intent that this capital will be repaid in later years.

As a cooperative member, you have the unique opportunity to be an owner-member in our business. Each year, we take all remaining margins and hold them aside to return to our members. These margins are called capital credits. The capital credits distributed to each member are determined by the electric use on his or her account for the specific year being returned.

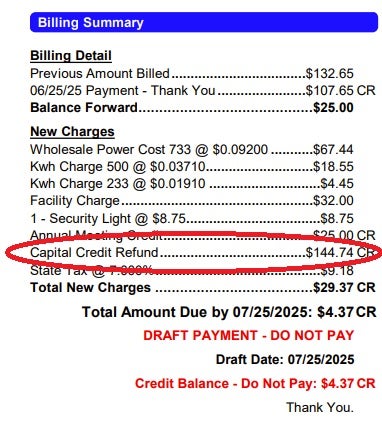

We are currently distributing capital credits from 1980 - 1982. If you are due capital credits, they will be returned to you in the form of a bill credit. Please see graphic below.